Key Factors

- 5 key tendencies ought to be on the prime of buyers’ minds as they enter the brand new quarter.

- Working via the elemental tendencies, all the best way to sector-specific pursuits within the inventory market, there’s alternative at every flip.

- Wall Road value targets and EPS projections help the upcoming capital rotation.

- 5 shares we like higher than Taiwan Semiconductor Manufacturing

The worldwide monetary markets are like a machine, and every asset class acts as a cog that twists and turns every cycle. In the present day, there are just a few key tendencies that buyers ought to pay attention to earlier than the quarter ends to assist them think about the most effective themes for rising their wealth.

Every step of the machine’s make-up incorporates actionable steps for buyers to observe and rotate a few of their capital out and in of respective asset lessons. Broader market members and even Wall Road analysts are conscious of those tendencies, which may begin with the Federal Reserve’s potential push to chop rates of interest this 12 months.

As a result of the worth of cash is often pushed by rates of interest, a primary smart step for buyers is to determine the place commodities (quoted in U.S. {dollars}) might be headed and the way the whole lot else might observe. For this primary step, think about Hess Co. NYSE: HES. Oil’s new yearly excessive may have an attention-grabbing impact on the iShares 20+ Yr Treasury Bond ETF NASDAQ: TLT.

Kickstarting the Machine: Oil and Bonds

The FedWatch tool on the CME Group Inc. says merchants priced in these potential cuts by September 2024. Probably decrease rates of interest may decrease the worth of the greenback index, bringing the worth per barrel greater. Reaching a close to nine-month excessive, oil tendencies might have at present priced in these cuts.

Discovering the suitable oil commerce might be treacherous, so here’s what Wall Road likes. The built-in oil and gasoline trade is projected to develop its earnings per share (EPS) by a mean price of 11% this 12 months. In distinction, Hess analysts suppose Hess may push out 32%.

Understanding that development would be the predominant focus in these unsure instances, Mizuho Monetary Group Inc. boosted its value goal on Hess as much as $205 a share, calling for a 30% upside from at this time’s costs. Greater than that, The PNC Monetary Companies Group Inc. purchased as much as $373,100 value of Hess inventory previously quarter.

Hess inventory trades at 94% of its 52-week excessive, so momentum has already began for power shares. Subsequent in line are bonds, which have attracted few consumers to push their yields down and mirror the potential Fed cuts.

Due to this, the iShares bond ETF trades at roughly $90 a share, a value not seen since 2011. As a result of bond costs transfer reverse to yields, buyers may catch this ETF at a cyclical low and trip it greater when the Fed throws within the towel and cuts charges.

American Manufacturing is in Play

As a result of the greenback is ready to say no, American exports might grow to be extra engaging to international consumers. The February ISM manufacturing PMI report recorded export orders at 6.4% greater than the earlier month because the sector prepares itself for the approaching export exercise.

The Japanese metal large Nippon Metal OTCMKTS: NISTF, positioned a bid in December 2023 to purchase out United States Metal Co. NYSE: X for $14.9 billion. Now that the Japanese Yen is at a 30-year low in opposition to the greenback, shopping for an American manufacturing agency looks like the cyclical alternative.

It’s All Concerning the Shopper

Even after rallying 32% previously 12 months, Simon Property (a mall owner-operator) nonetheless pays a . Additionally, its P/E valuation of 20.8x places it at greater than 50% under the true property funding belief () trade’s 44.5x a number of.

Over the previous quarter, Morgan Stanley and The Goldman Sachs Group Inc. analysts boosted their value targets on the inventory. Regardless of cussed inflation charges within the U.S., the prospect of doubtless decrease charges has buyers enthusiastic about this shopper discretionary play.

The A.I. Race

And who can keep in mind the expertise shares bringing indexes to all-time highs? After carrying the crown for some time, Nvidia Co. NASDAQ: NVDA is starting to lift questions on whether or not its value is overextended.

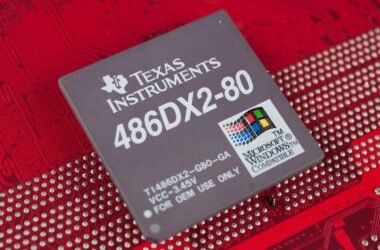

After assigning $11 billion to Taiwan Semiconductor Manufacturing Co. NYSE: TSM, the U.S. authorities inherently expressed its desire – and confidence – for TSMC to hold out its plan for .

Over the previous 12 months, TSMC inventory underperformed Nvidia by as a lot as 173%, a spot that the favored fundamentals and U.S. backing might fill.

Earlier than you think about Taiwan Semiconductor Manufacturing, you may wish to hear this.

MarketBeat retains monitor of Wall Road’s top-rated and greatest performing analysis analysts and the shares they advocate to their shoppers every day. MarketBeat has recognized the 5 shares that prime analysts are quietly whispering to their shoppers to purchase now earlier than the broader market catches on… and Taiwan Semiconductor Manufacturing wasn’t on the checklist.

Whereas Taiwan Semiconductor Manufacturing at present has a “Average Purchase” ranking amongst analysts, top-rated analysts imagine these 5 shares are higher buys.

View The 5 Shares Right here

Because the AI market heats up, buyers who’ve a imaginative and prescient for synthetic intelligence have the potential to see actual returns. Study concerning the trade as an entire in addition to seven firms which might be getting work finished with the facility of AI.