(As of 10:15 AM ET)

- 52-Week Vary

- $15.97

▼

$52.48

- Value Goal

- $32.97

Affirm NASDAQ: AFRM has seen wild fluctuations in its inventory value over the previous three years. Shares peaked at practically $169 in November 2021 however are down 80% from that degree as we speak. Nonetheless, shares are up 82% prior to now 52 weeks.

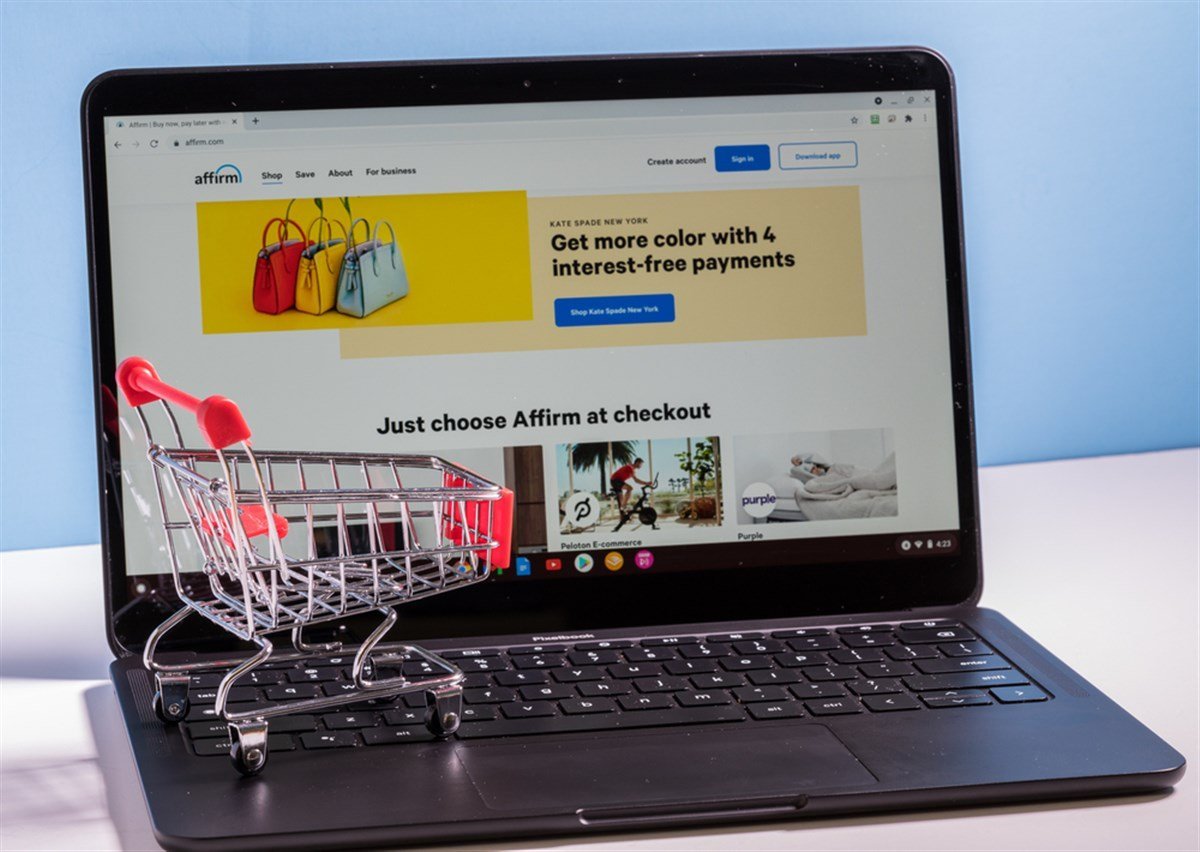

Buyers may acknowledge the fintech firm as a fee choice allowed when making on-line purchases. Affirm usually pops up when trying out on-line to repay a purchase order in installments, topic to a credit score test.

Let’s dive into the corporate’s annual monetary assertion to know higher what it does. We’ll then study latest information and the agency’s monetary outcomes and shut by offering some outlook on the corporate.

Breaking Down Affirms Operations and New Relationship with Main Magazine-7 Agency

Affirm operates as one reportable segment. Nonetheless, it has two most important buyer sorts: retailers and customers. The corporate brings in income from retailers by charging them a price when a transaction is made utilizing Affirm’s purchase now pay later (BNPL) fee choice. The price is normally increased if the curiosity costs on the fee plan are decrease.

When prospects make purchases utilizing Affirm’s fee choice, it cuts into an organization’s margins on that sale. Nonetheless, retailers nonetheless have an enormous incentive to make use of Affirm because it helps enhance general gross sales. Clients who could also be afraid to make large purchases at one time are extra seemingly to take action if Affirm is an choice.

The corporate generates income from customers based mostly on curiosity costs for its fee plan. It doesn’t cost late fee charges. It additionally has a market app the place prospects should buy straight from retailers. Within the fiscal 12 months 2023, 20% of Affirm’s transactions occurred within the app. Lastly, the Affirm Card permits prospects to transform debit purchases into installment loans.

A giant supply for potential progress is Affirm’s partnership with Apple NASDAQ: AAPL. Its BNPL plan can be out there as an choice in Apple Pay in late 2024. Nonetheless, traders must wait to see the impact. Affirm says it doesn’t see a cloth influence on revenues till 2026.

It’s because the agency can be rolling out the characteristic to Apple customers slowly to handle danger. It needs to repair points which may happen whereas using the characteristic is comparatively small. That is in order that these points don’t turn out to be the huge issues that they could if everybody had entry initially.

Nonetheless, this isn’t an unique settlement. Clients may even be capable of use BNPL choices by means of Citigroup NYSE: C, Synchrony Monetary NYSE: SYF, and Fiserv NYSE: FI.

Revenues are Robust and Profitably Could Be Turning the Nook

The corporate has grown revenues solidly since going public in 2021. Revenues grew 51% from a 12 months in the past in fiscal Q3 2024. Working margin recovered from -80% in March 2023 to -37% in March 2024.

Though income progress is powerful, internet earnings remains to be deeply adverse. The corporate’s losses neared half a billion {dollars} within the 12-month interval ending in fiscal Q3. Nonetheless, in its final earnings launch, the agency articulated a timeline for when it hopes to attain working profitability on a non-adjusted foundation.

Affirm posted fiscal Q4 2024 earnings that blew estimates out of the water on Aug. 28. Its lack of $0.14 per share was an enormous lower from the fiscal Q3 lack of $0.43. Income grew 14% from Q3 and 38% from the earlier 12 months’s quarter. Income got here in 9% above expectations.

Affirm Is Silencing the Doubters

Its regularly rising Transactions per Lively Consumer are a very good signal. Funds from these prospects are increased margin and present that current prospects just like the product and are utilizing it extra. The Fed probably getting into an rate of interest lower regime would supply a tailwind, and the corporate might actually take off throughout a interval of decrease charges.

Earlier than you contemplate Fiserv, you will wish to hear this.

MarketBeat retains monitor of Wall Avenue’s top-rated and greatest performing analysis analysts and the shares they suggest to their shoppers every day. MarketBeat has recognized the 5 shares that prime analysts are quietly whispering to their shoppers to purchase now earlier than the broader market catches on… and Fiserv wasn’t on the record.

Whereas Fiserv at the moment has a “Reasonable Purchase” ranking amongst analysts, top-rated analysts consider these 5 shares are higher buys.

Do you count on the worldwide demand for power to shrink?! If not, it is time to try how power shares can play an element in your portfolio.