In 2021, the time period SPAC grew to become a part of the investor’s dictionary. SPAC stands for particular objective acquisition firm, and it was a approach many corporations went public in 2020 and 2021. A lot of these corporations had been within the electrical car (EV) business. And never simply automobile producers however any firm that impacted the EV provide chain, together with battery manufacturing.

Two of those corporations had been Microvast Holdings Inc. NASDAQ: MVST and FREYR Battery SA NYSE: FREY. Each Microvast and FREYR Battery are thought-about enterprise companies shares. However they don’t seem to be simply penny shares; they’re micro penny shares. The mixed market capitalization of the 2 corporations is round $266 million. And, like many SPAC corporations, Microvast and FREYR Battery have considerably underperformed the S&P 500 since 2021.

However should you’re a speculative investor who has the capital to put aside for a corporation that would ship transformational know-how, what do it is advisable to learn about every of those shares?

Microvast: Producing the Subsequent Era of Lithium-Ion Batteries

(As of 08/16/2024 08:51 PM ET)

- 52-Week Vary

- $0.30

▼

$2.47

- Value Goal

- $4.50

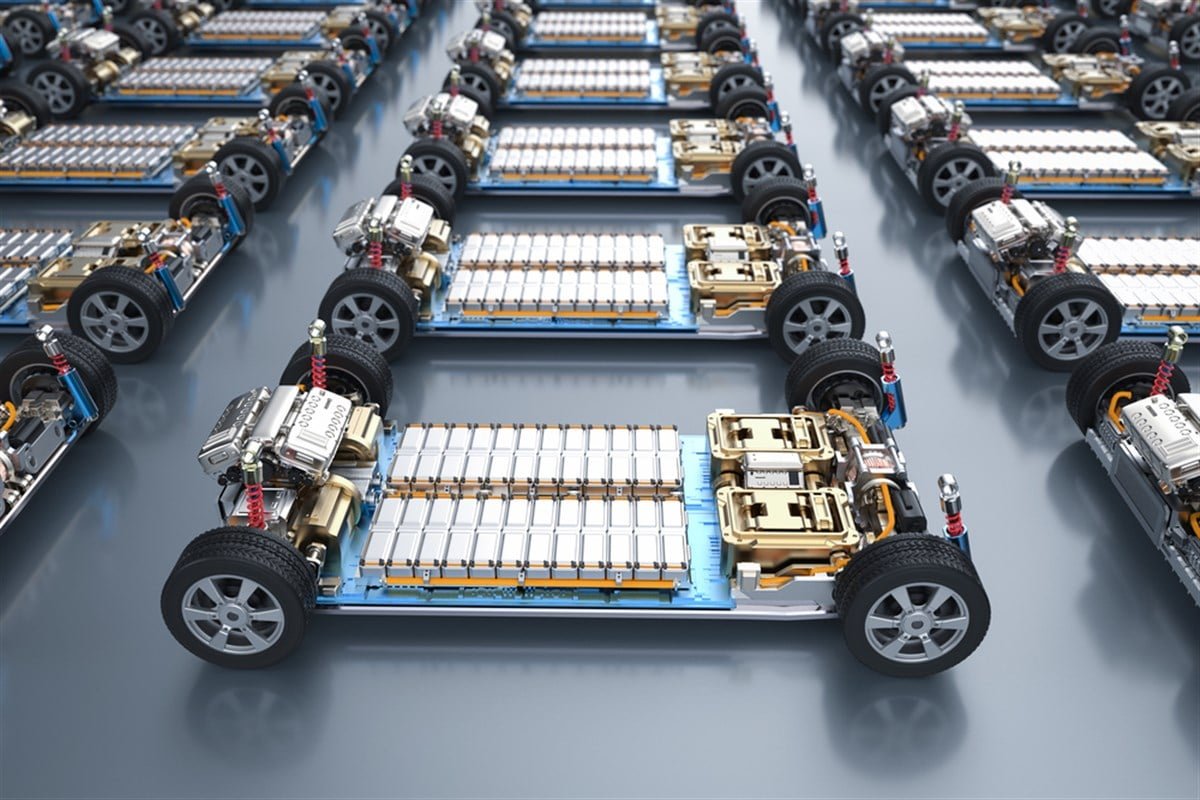

Microvast designs, develops, and manufactures lithium-ion battery options. The vertically built-in firm is a acknowledged innovator within the sector, and its merchandise cowl business transportation, heavy gear, and power storage options.

On the optimistic aspect, Microvast has over 630 patents and controls each side of its improvement course of beginning with analysis & improvement via to manufacturing.

In its second-quarter 2024 earnings report, delivered on August 9, the corporate introduced a record $84 million in revenue. This was 12% larger YoY, nevertheless it missed analysts’ expectations of $87.5 million. The corporate additionally reported damaging earnings per share of 21 cents, which was considerably worse than the damaging one-cent EPS analysts anticipated.

In a separate regulatory submitting because the earnings report, the corporate introduced it was suspending construction of its factory in Clarksville, Tennessee. Like many small corporations, the development is being held up as a consequence of financing. As soon as up and operating the plant is anticipated to convey 290 jobs.

MVST inventory was already heading decrease after the earnings report. The information in regards to the building delay has pushed it to a 52-week low of round 31 cents.

FREYR: Addressing the Soiled Secret of Many Clear Vitality Options

(As of 08/16/2024 08:51 PM ET)

- 52-Week Vary

- $1.10

▼

$6.89

- Value Goal

- $3.63

FREYR Battery is a Norwegian firm that’s working to create industrial-scale clear power battery options for power storage, EV, and marine functions. In doing so, the corporate is highlighting one of many issues within the international shift to electrical automobiles – notably those who use lithium-ion batteries. That’s, they’re not really clear power.

Whereas that sounds good on paper, turning this imaginative and prescient into actuality will take time. Not solely is FREYR Battery unprofitable it’s producing little to no income. Including to the puzzle for buyers, the corporate has but to construct its first gigafactory in its residence nation. And whereas it has plans to construct a manufacturing unit in the USA, that appears to be years away.

Nevertheless, within the firm’s most up-to-date earnings presentation, it reported having $222 million in money and no debt. FREYR believes it has a money runway into 2026 with the corporate forecasting first revenue in 2025.

After initially falling after the report, FREY inventory has recovered barely, nevertheless it’s nonetheless down about 35% in 2024 and can also be buying and selling close to its 52-week low.

If You Needed to Decide One…

Small-cap corporations, notably unprofitable ones, don’t usually obtain plenty of analyst protection. That’s true of each Microvast and FREYR Battery. Nevertheless, the 4 analysts which have issued a worth goal on MVST inventory give it a consensus worth goal of $4.50. That is over 1,350% above its August 16, 2024 worth.

Earlier than you take into account Microvast, you will wish to hear this.

MarketBeat retains observe of Wall Avenue’s top-rated and finest performing analysis analysts and the shares they advocate to their purchasers each day. MarketBeat has recognized the 5 shares that high analysts are quietly whispering to their purchasers to purchase now earlier than the broader market catches on… and Microvast wasn’t on the record.

Whereas Microvast presently has a “Reasonable Purchase” score amongst analysts, top-rated analysts consider these 5 shares are higher buys.

Because the AI market heats up, buyers who’ve a imaginative and prescient for synthetic intelligence have the potential to see actual returns. Study in regards to the business as a complete in addition to seven corporations which might be getting work finished with the ability of AI.