The U.S. economic system remained resilient early this yr, with a robust job market fueling sturdy shopper spending. The difficulty is that inflation was resilient, too.

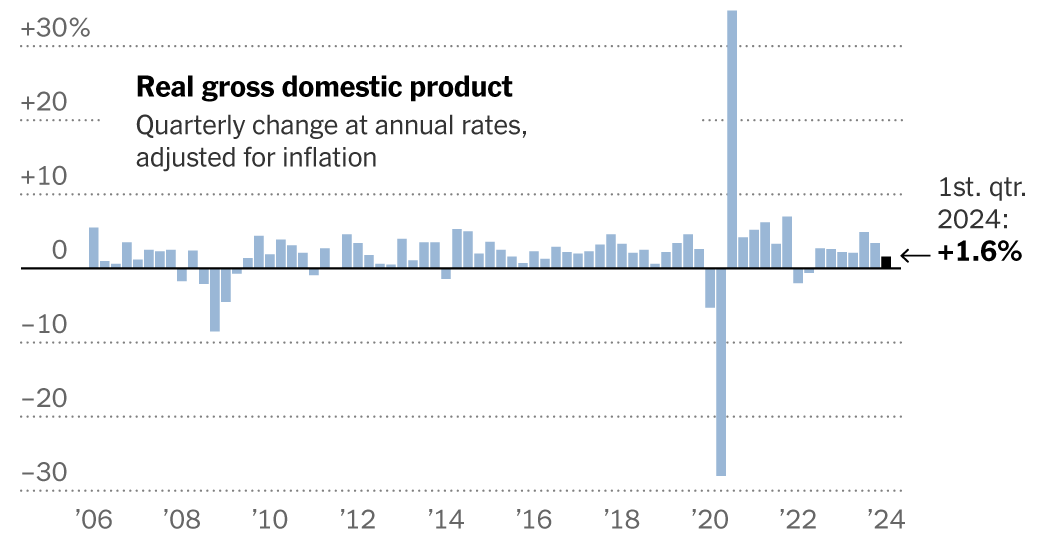

Gross home product, adjusted for inflation, elevated at a 1.6 p.c annual price within the first three months of the yr, the Commerce Division said on Thursday. That was down sharply from the three.4 p.c progress price on the finish of 2023 and fell nicely wanting forecasters’ expectations.

Economists have been largely unconcerned by the slowdown, which stemmed principally from large shifts in enterprise inventories and worldwide commerce, parts that always swing wildly from one quarter to the subsequent. Measures of underlying demand have been considerably stronger, providing no trace of the recession that forecasters spent a lot of final yr warning was on the best way.

“It could recommend some moderation in progress however nonetheless a stable economic system,” stated Michael Gapen, chief U.S. economist at Financial institution of America. He stated the report contained “few indicators of weak point total.”

However the stable progress figures have been accompanied by an unexpectedly fast acceleration in inflation. Shopper costs rose at a 3.4 p.c annual price within the first quarter, up from 1.8 p.c within the ultimate quarter of final yr. Excluding the risky meals and vitality classes, costs rose at a 3.7 p.c annual price.

Taken collectively, the first-quarter information was the most recent proof that the Federal Reserve’s efforts to tame inflation have stalled — and that the celebration in monetary markets over an obvious “smooth touchdown” or mild slowdown for the economic system had been untimely.

“It will increase the probabilities of a tougher touchdown,” stated Constance L. Hunter, an economist at MacroPolicy Views, a forecasting agency. “The inflation information was the shock.”

At a minimal, cussed inflation is prone to imply that the Fed will wait at the very least till fall to start chopping rates of interest. Some forecasters assume it’s doable that policymakers received’t simply hold charges “increased for longer,” as buyers have been anticipating for a number of weeks now, however would possibly really increase them additional.

“It’s a big shift as a result of impulsively ‘increased for longer’ might imply one other hike,” stated Diane Swonk, chief economist at KPMG. For now, she stated, the Fed is caught in “financial coverage purgatory.”

Monetary markets fell on the information. The S&P 500 index ended the day down about half a proportion level, and yields on authorities bonds rose as buyers anticipated that borrowing prices will stay excessive.

Traders aren’t the one ones who might endure if rates of interest stay excessive. There are mounting indicators that top borrowing prices are weighing on People’ monetary well-being. Shoppers saved simply 3.6 p.c of their after-tax revenue within the first quarter, down from 4 p.c on the finish of final yr and greater than 5 p.c earlier than the pandemic.

The indicators of pressure are notably acute for lower-income households. They’ve more and more turned to bank cards to afford their spending, and with rates of interest excessive, extra of them are falling behind on their funds.

“There’s a sense that lower-end households are more and more stretched proper now,” stated Andrew Husby, senior U.S. economist at BNP Paribas.

But regardless of these strains, shopper spending, within the combination, reveals little signal of cooling down. Spending rose at a 2.5 p.c annual price within the first quarter, solely modestly slower than in late 2023, and spending on companies like journey and leisure really accelerated.

Spending has been pushed notably by wealthier customers, whose low debt and fixed-rate mortgages have insulated them from the consequences of upper rates of interest, and who’ve benefited from a inventory market that was till not too long ago setting information.

“Greater revenue households really feel very flush,” stated Brian Rose, senior economist at UBS. “They’ve seen such an enormous run-up within the worth of their home and the worth of their portfolios that they really feel like they’ll hold spending.”

That presents a conundrum for the policymakers on the Fed: Their major software for preventing inflation, excessive charges, is doing little to tamp down spending by the rich whereas hurting poorer households. And but in the event that they lower these charges, inflation might speed up once more.

Even so, forecasters stated the general financial image stays surprisingly rosy, particularly in comparison with the glum predictions of a yr in the past. Unemployment has remained low, job progress has stayed robust and wages have continued to rise, all of which helped after-tax revenue to outpace inflation within the first quarter.

Companies stepped up their funding in gear and software program within the first quarter, a vote of confidence within the economic system. The housing market additionally rebounded, though that was due partly to a dip in mortgage charges that has since reversed.

Even one of many drags on progress within the first quarter — a swelling commerce deficit — principally mirrored demand from the US. Imports rose as People purchased extra items from abroad, whereas exports rose extra modestly.