If the financial system is slowing down, no one advised the labor market.

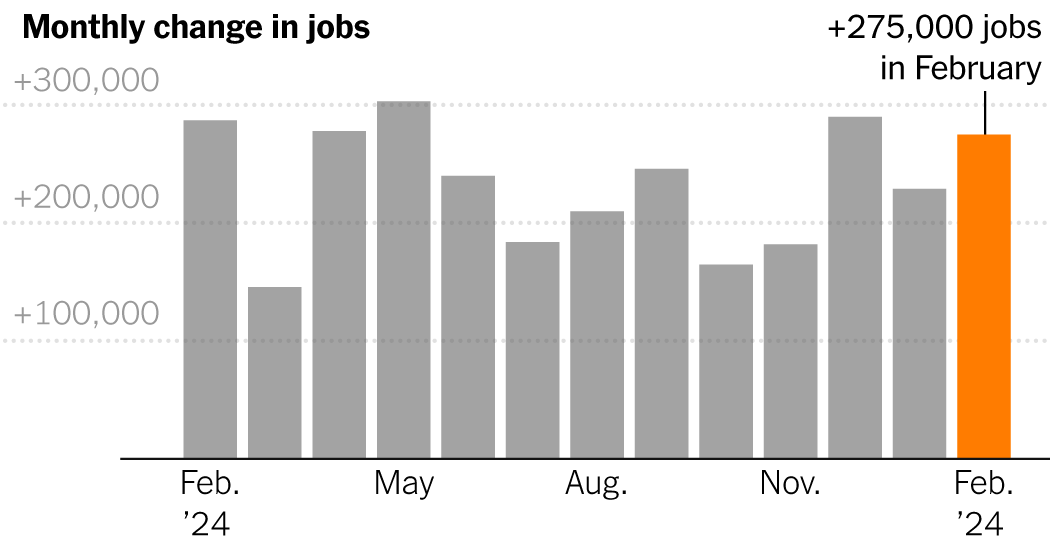

Employers added 275,000 jobs in February, the Labor Division reported Friday, in one other month that exceeded expectations.

It was the third straight month of beneficial properties above 200,000, and the thirty eighth consecutive month of progress — recent proof that after surging again from the pandemic shutdowns, America’s jobs engine nonetheless has loads of steam.

“We’ve been anticipating a slowdown within the labor market, a extra materials loosening in circumstances, however we’re simply not seeing that,” mentioned Rubeela Farooqi, chief economist at Excessive Frequency Economics.

The earlier two months, December and January, have been revised down by a mixed 167,000 jobs, reflecting the upper diploma of statistical volatility within the winter months. That doesn’t disrupt an image of constant sturdy will increase, which now appears to be like barely smoother.

On the identical time, the unemployment fee, primarily based on a survey of households, elevated to a two-year excessive of three.9 p.c, from 3.7 p.c in January. A extra expansive measure of slack labor market circumstances, which incorporates folks working half time who would quite work full time, has been steadily rising and now stands at 7.3 percent.

The unemployment fee was pushed by folks shedding or leaving jobs in addition to these getting into the labor pressure to search for work. The labor pressure participation fee for folks of their prime working years — ages 25 to 54 — jumped again as much as 83.5 p.c, matching a stage from final 12 months that was the best for the reason that early 2000s.

Common hourly earnings rose by 4.3 p.c over the 12 months, though the tempo of will increase has been fading.

“We’ve not too long ago seen beneficial properties in actual wages, and that’s inspired folks to re-enter the labor market, and that’s a very good growth for employees,” mentioned Kory Kantenga, a senior economist on the job search web site LinkedIn. As wage progress slows, he mentioned, the chance that extra folks will begin searching for work falls.

As late as final fall, economists have been predicting far more modest employment will increase, with hiring concentrated in a number of industries. However whereas some pandemic-inflated industries have shed jobs, anticipated downturns in sectors like development haven’t materialized. Rising wages, enticing advantages and extra versatile work schedules have drawn thousands and thousands of employees off the sidelines.

Elevated ranges of immigration have additionally added to the labor provide. In accordance with an analysis by the Brookings Institution, the inflow has roughly doubled the variety of jobs that the financial system may add per 30 days in 2024 with out placing upward stress on inflation, to between 160,000 and 200,000.

Well being care and authorities once more led the payroll beneficial properties in February, whereas development continued its regular improve. Retail and transportation and warehousing, which have been flat to unfavorable in latest months, picked up.

No main industries misplaced a considerable variety of jobs. Credit score intermediation continued its downward slide — that sector, which principally consists of industrial banking, has misplaced about 123,000 jobs since early 2021.

That doesn’t imply the employment panorama appears to be like rosy to everybody. Worker confidence, as measured by the company rating website Glassdoor, has been falling steadily as layoffs by tech and media corporations have grabbed headlines. That’s very true in white-collar professions like human assets and consulting, whereas these in professions that require working in individual — corresponding to well being care, development and manufacturing — are extra upbeat.

“It’s a two-track labor market,” mentioned Aaron Terrazas, Glassdoor’s chief economist, noting that job searches are taking longer for folks with graduate levels. “For expert employees in risk-intensive industries, anybody who’s been laid off is having a tough time discovering new jobs, whereas if you happen to’re a blue-collar or frontline service employee, it’s nonetheless aggressive.”

The previous couple of months have been studded with robust financial knowledge, main analysts surveyed by the Nationwide Affiliation for Enterprise Economics to boost their forecasts for gross home product and decrease their expectations for the trajectory of unemployment. It’s occurred whilst inflation has eased, main the Federal Reserve to telegraph its plans for rate of interest cuts someday this 12 months, which has raised progress expectations additional.

Mervin Jebaraj, director of the Middle for Enterprise and Financial Analysis on the College of Arkansas, helped tabulate the survey responses. He mentioned the temper was buoyed partly by fading trepidation over federal authorities shutdowns and draconian price range cuts, after a number of shut calls for the reason that fall. And he sees no apparent purpose for the restoration to finish quickly.

“As soon as it begins going, it retains going,” Mr. Jebaraj mentioned. “You had this exterior stimulus with all of the trillions of {dollars} of presidency spending, Now it’s kind of self-sustaining, regardless that the cash’s gone.”