Jerome H. Powell, the Federal Reserve chair, reiterated Tuesday that policymakers had been poised to carry rates of interest regular at a excessive stage as they waited for proof that inflation is slowing additional.

Fed officers entered 2024 anticipating to make rate of interest cuts, having lifted borrowing prices sharply to a greater than two-decade excessive of 5.3 p.c between 2022 and the center of final yr. However stubbornly speedy inflation in latest months has upended that plan.

Central bankers have been clear that charge cuts this yr are nonetheless attainable, however they’ve additionally signaled that they’re planning to go away rates of interest on maintain for now as they wait to ensure that inflation is genuinely coming below management.

Talking throughout a panel dialogue in Amsterdam, Mr. Powell stated officers had been stunned by latest inflation readings. The Client Worth Index inflation measure, which is ready for launch on Wednesday, got here down quickly in 2023 however has gotten caught above 3 p.c this yr. The Fed’s most well-liked measure, the Private Consumption Expenditures index, is barely cooler, nevertheless it, too, stays properly above the Fed’s 2 p.c inflation objective.

“We didn’t anticipate this to be a clean street, however these had been greater than I feel anyone anticipated,” Mr. Powell stated on Tuesday of latest inflation readings. “What that has instructed us is that we’ll should be affected person and let restrictive coverage do its work.”

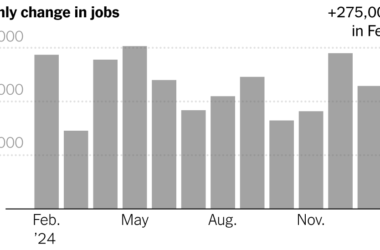

Mr. Powell stated that he anticipated continued progress and a robust labor market within the months forward, and that he believed inflation would start to gradual once more.

However, he stated, “my confidence in that isn’t as excessive because it was, having seen these readings within the first three months of the yr.”

The Fed chair made clear that additional rates of interest will increase will not be anticipated, although not not possible. He stated that there was a “very small chance” that the Fed would want to entertain lifting once more, however that he didn’t suppose that was the more than likely end result.

“It’s actually a query of retaining coverage on the present charge for an extended time than had been thought,” Mr. Powell stated. “The query is: Is it sufficiently restrictive? And I feel that’s going to be a query that point should inform.”

The Fed chair stated he nonetheless anticipated hire, a serious driver of the latest inflation, to finally pull down worth will increase. However he acknowledged that the cool-down was taking longer than anticipated.

He additionally famous that it might be taking longer for coverage to work this time round, partially as a result of householders and companies locked in very low rates of interest when borrowing prices had been at all-time low within the 2010s and in 2020.

“The U.S. financial system is totally different this time,” Mr. Powell stated.

Nonetheless, he stated repeatedly that he thought rates of interest had been excessive sufficient to step by step weigh on progress and finally carry inflation down the remainder of the way in which.

“At the start, we had been very involved that the very excessive inflation we noticed may be fairly tough to carry down and not using a very important decline in employment and weakening financial exercise — that didn’t occur, that’s only a nice outcome,” Mr. Powell stated.

Despite the fact that inflation has come down considerably from its highs in 2022, People are unhappy with the state of the financial system, a reality that’s clear in low client confidence ranges. Mr. Powell attributed that dissatisfaction to continued excessive worth ranges.

As a result of inflation measures adjustments in worth, slower inflation simply signifies that costs are now not going up as shortly, not that they’re coming down after their speedy 2021 and 2022 run-up.

“You inform folks, ‘Inflation is coming down,’ and so they suppose, ‘I don’t perceive that,’” Mr. Powell stated. “Notably folks on the decrease finish of the revenue spectrum are very arduous hit by inflation, from the beginning, which is why we’re so dedicated to restoring worth stability and retaining it in place.”