The recession America was anticipating by no means confirmed up.

Many economists spent early 2023 predicting a painful downturn, a view so broadly held that some commentators began to treat it as a given. Inflation had spiked to the best stage in many years, and a variety of forecasters thought that it could take a drop in demand and a prolonged jump in unemployment to wrestle it down.

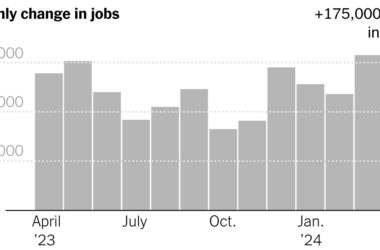

As a substitute, the economic system grew 3.1 p.c final yr, up from lower than 1 p.c in 2022 and quicker than the typical for the 5 years main as much as the pandemic. Inflation has retreated considerably. Unemployment stays at historic lows, and shoppers proceed to spend even with Federal Reserve rates of interest at a 22-year excessive.

The divide between doomsday predictions and the heyday actuality is forcing a looking on Wall Road and in academia. Why did economists get a lot fallacious, and what can policymakers be taught from these errors as they attempt to anticipate what would possibly come subsequent?

It’s early days to attract agency conclusions. The economic system might nonetheless decelerate as two years of Fed charge will increase begin to add up. However what is obvious is that outdated fashions of how progress and inflation relate didn’t function correct guides. Dangerous luck drove extra of the preliminary burst of inflation than some economists appreciated. Good luck helped to decrease it once more, and different surprises have hit alongside the best way.

“It’s not like we understood the macro economic system completely earlier than, and this was a fairly distinctive time,” stated Jason Furman, a Harvard economist and former Obama administration financial official who thought that reducing inflation would require increased unemployment. “Economists can be taught an enormous, wholesome dose of humility.”

Economists, in fact, have a protracted historical past of getting their predictions fallacious. Few noticed the worldwide monetary disaster coming earlier this century, even as soon as the mortgage meltdown that set it off was properly underway.

Nonetheless, the latest misses have been notably large. First, many economists dismissed the potential for fast inflation. When costs took off, Fed economists {and professional} forecasters widely expected at the least a short interval of contraction and an uptick in unemployment. Neither has materialized, at the least thus far.

“It was all the time going to be troublesome to forecast what an economic system was going to appear like rising from a largely unprecedented pandemic,” stated Matthew Luzzetti, chief economist at Deutsche Financial institution, whose workforce’s recession forecast final yr proved too pessimistic.

Not all economists anticipated a recession final yr. Some appropriately anticipated inflation to fall as pandemic disruptions pale. However even most of them have been stunned by how little harm the Fed’s marketing campaign of charge will increase seems to have triggered.

“The unemployment charge hasn’t even gone up because the Fed began tightening,” stated Alan S. Blinder, a Princeton economist who served as vice chairman of the Fed over the last profitable mushy touchdown and was a outstanding voice arguing one other one was potential. “I don’t understand how many individuals anticipated that. I do know I didn’t.”

The sequence of forecasting errors began in early 2021.

Again then, a handful of outstanding economists, together with Harvard’s Lawrence H. Summers, a former Treasury secretary, started to warn that America might expertise a pop in inflation because the newly elected Biden administration enacted a big stimulus bundle — together with one-time checks and state and native support — on high of earlier Trump administration coronavirus reduction. They fearful that the cash would gasoline a lot demand that it could push costs up.

Many authorities officers and economists vociferously doubted that inflation would soar, however the value pop arrived. A few of it was about demand, and a few of it owed to dangerous luck and pandemic disruptions.

Stimulus cash and way of life modifications tied to the pandemic had helped to stoke items procuring at a second when the provision chains set as much as ship these merchandise have been below pressure. Ocean delivery routes weren’t ready to deal with the deluge of demand for couches and gymnasium tools. On the similar time, producers confronted rolling closures amid virus outbreaks.

Russia’s 2022 invasion of Ukraine additional fueled the soar in costs by disrupting international meals and gasoline provides.

By that summer time, America’s Client Worth Index had peaked at a 9.1 p.c yearly enhance and the Fed had began to reply in a means that made economists suppose {that a} recession was imminent.

Fed policymakers in March 2022 started what shortly grew to become a fast sequence of charge will increase. The objective was to make it sharply dearer to purchase a home or automotive or to develop a enterprise, which might in flip gradual the economic system, weigh on shopper demand and power corporations to cease elevating costs a lot.

Such emphatic charge changes meant to chill inflation have sometimes spurred recessions, so forecasters started to foretell a downturn.

“Historical past has proven that these two issues mixed normally ended up in recession,” stated Beth Ann Bovino, chief economist for U.S. Financial institution, referring to the mixture of excessive inflation and charge will increase.

However the economic system — whereas a difficult one for some households, between excessive costs and costly mortgages — by no means fell off that cliff. Hiring slowed regularly. Client spending cooled, however in matches and begins and by no means sharply. Even the interest-rate-sensitive housing market settled down with out tanking.

Sturdy authorities assist helps to elucidate a few of the resilience. Households have been flush with financial savings amassed in the course of the pandemic, and state and native authorities have been solely slowly spending down their very own authorities pandemic cash.

On the similar time, a robust job market helped to push up wages, permitting many households to climate value will increase with out having to chop again a lot. Years of ultralow rates of interest had additionally given households and companies the possibility to refinance their money owed, making them much less delicate to the Fed’s marketing campaign.

And a part of the persistent energy owed to the truth that with inflation cooling, Fed officers might again off earlier than they crushed the economic system. They paused charge will increase after July 2023, leaving them at a variety of 5.25 to five.5 p.c.

That raises a query: Why has inflation cooled even because the Fed stopped wanting tanking progress?

Many economists beforehand thought {that a} extra marked slowdown was prone to be needed to totally stamp out fast inflation. Mr. Summers, for example, predicted that it could take years of joblessness above 5 p.c to wrestle value will increase again below management.

“I used to be of the view that mushy landings” have been “the triumph of hope over expertise,” Mr. Summers stated. “That is wanting like a case the place hope has triumphed over expertise.”

He pointed to a number of elements behind the shock: Amongst them, provide issues have eased greater than he anticipated.

An enormous chunk of the disinflation did come from a reversal of earlier dangerous luck. Gasoline costs dropped in 2023, and people softer costs trickled by different industries. Therapeutic provide chains allowed good costs to cease climbing so shortly and, in some instances, fall.

And a few financial cooling did happen. Although unemployment held pretty regular, the labor market rebalanced in different methods: There have been about two job openings for each accessible employee again in 2022. That’s right down to 1.4 now, and wage progress has cooled as employers compete much less fiercely to rent.

However that labor market adjustment was gentler than many had anticipated. Outstanding economists had doubted it could be potential to chill situations by slicing job openings with out additionally inflicting a spike in unemployment.

“I might have thought that it was an iron legislation that disinflation is painful,” stated Laurence M. Ball, a Johns Hopkins economist who was an writer of an influential 2022 paper that argued bringing down inflation would most likely require driving up unemployment. “The broad lesson, which we by no means appear to utterly be taught, is that it’s very arduous to forecast issues and we shouldn’t be too assured, and particularly when there’s a really bizarre, historic occasion like Covid.”

Now, the query is what which means for the months forward. May economists be caught wrong-footed once more? They anticipate moderating inflation, continued progress and several other Fed charge cuts this yr.

“We’ve landed softly; we simply must make it to the gate,” Mr. Furman stated.

Fed officers might supply perception into their very own pondering at their assembly subsequent week, which concludes on Wednesday. Buyers anticipate policymakers to carry rates of interest regular, however will watch a information convention with Jerome H. Powell, the Fed chair, for any trace on the future.